THE Asian Development Bank (ADB) said it expects to approve $1.2 billion representing the first tranche of the Laguna Lakeshore Road Network (LLRN) project loan before year’s end.

“We are in the last stages of having the Laguna Lakeshore Road Network Project presented to our board for approval,” ADB Country Director for the Philippines Pavit Ramachandran told reporters on the sidelines of an event on Monday.

“We’re looking to have the Laguna Lakeshore Road Network approved later this year.”

Other funders are the Export-Import Bank of Korea ($904.35 million) and the Asian Infrastructure Investment Bank ($188.18 million).

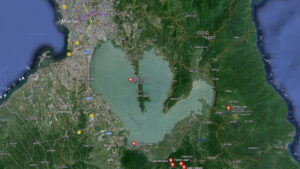

Targeted for completion by 2027, the LLRN consists of a 37.5-kilometer primary road and a 12.0-kilometer viaduct connecting Lower Bicutan, Taguig and Tunasan, Muntinlupa.

It includes a 25.5-kilometer shoreline viaduct and embankment from Tunasan to Calamba, Laguna, and connecting roads to other towns in Laguna.

The LLRN is expected to improve road connectivity from the capital region to areas directly south of it, boosting economic activity in the area.

The ADB will also approve a $500-million contingent disaster facility this year, a stand-by fund that would allow provide access to emergency funds during calamities.

Also for approval this year is a $500-million loan to support public financial management reforms.

For 2025, the ADB is supporting the construction of the Metro Rail Transit Line 4 (MRT-4) as well as flood management projects nationwide.

“We will be supporting the MRT-4 next year. We have a number of flood disaster resilience projects in several river basins…Tagum, Abra, other river basins in Mindanao and Luzon and other areas.”

The government is seeking a $1-billion loan from the ADB to help fund the MRT-4. It is also proposing $537.4 million in loans from the AIIB.

The MRT-4 is a 10-station commuter railway of about 12.7 kilometers from the Epifanio de los Santos Avenue (EDSA)-Ortigas Ave. junction to Taytay, Rizal. It is expected to serve more than 400,000 passengers daily.

Also up for approval is the $500-million Climate Change Action Program, which would support the transition to a climate-resilient and low-carbon economy.

ADB loans to the Philippines are expected to hit at least $24 billion until 2029, according to the bank’s Country Partnership Strategy.

“Our Country Partnership Strategy is really very focused on supporting the Philippines in its efforts to intensify climate action… Primarily, I think the focus here is on climate resilience and climate adaptation,” Mr. Ramachandran said.

The ADB is also assisting the government in identifying new public-private partnership projects, and is helping the Bangsamoro Autonomous Region in Muslim Mindanao in drafting its own revenue code, he added. — Beatriz Marie D. Cruz