THE House of Representatives will adopt the Senate’s version of a measure allowing tourists to claim value-added tax (VAT) refunds, with a legislator citing “direct instructions” from President Ferdinand R. Marcos, Jr. to expedite the bill’s approval.

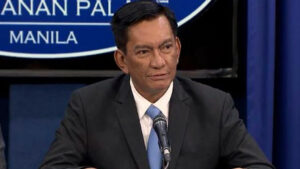

The House’s version was deemed to contain “no substantial or fundamental differences with the House version,” Albay Rep. Jose Ma. Clemente S. Salceda said.

Both House Bill No. 7292 and Senate Bill No. 2415 allow a VAT refund on P3,000 worth of goods provided they are taken out of the country within 60 days.

The Senate version adds that the P3,000 threshold is subject to a review every three years by the Finance department, with the department required to employ the services of “reputable, globally recognized, and experienced VAT refund operators” to establish the refund system.

“We are very amenable to the Senate version, which doesn’t really deviate much from the House version,” he said in a statement.

As such, the measure will no longer require a bicameral conference committee to convene to harmonize both chambers’ versions.

Mr. Salceda, who heads the House ways and means panel, said he will recommend to Speaker and Leyte Rep. Ferdinand Martin G. Romualdez for the chamber to adopt the measure in plenary.

The measure’s approval is expected to spur tourist spending, according to Mr. Salceda.

“Together with more modern airports and investments in the hospitality sector, we hope that the VAT refund for tourists will boost the country’s bid for more tourist dollars,” he said.

“It’s part of a comprehensive strategy to bolster tourism. We are anticipating NAIA (Ninoy Aquino International Airport) improvements with the privatization, as well as the new Bulacan Airport,” Mr. Salceda said.

The government could apply the tourist VAT refund system to other taxes, should the chosen provider do a “great job,” he said. He raised the prospect of helping the government improve its performance in VAT refunds overall. — Kenneth Christiane L. Basilio